Support Document

How NON-CASH Adjustment Work in POS?

Please follow the below steps:-

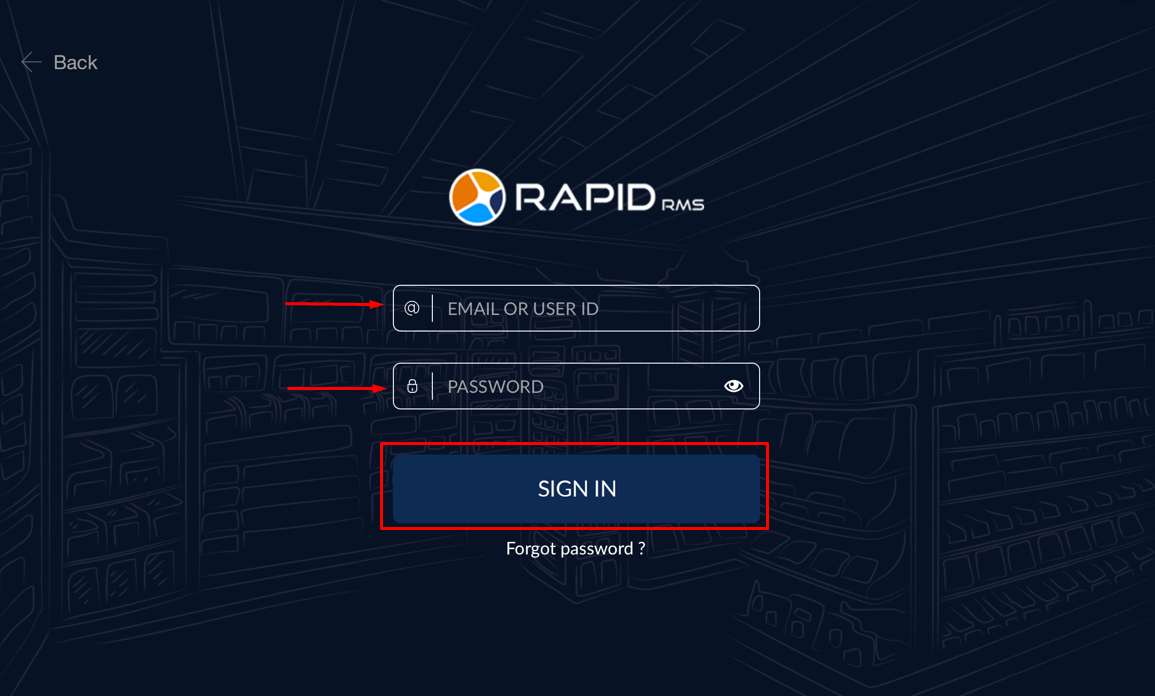

- Login to RapidRMS Application with your credentials.

- • Enter your Email OR User ID.

- • Enter your Password.

- • Click on SIGN IN button.

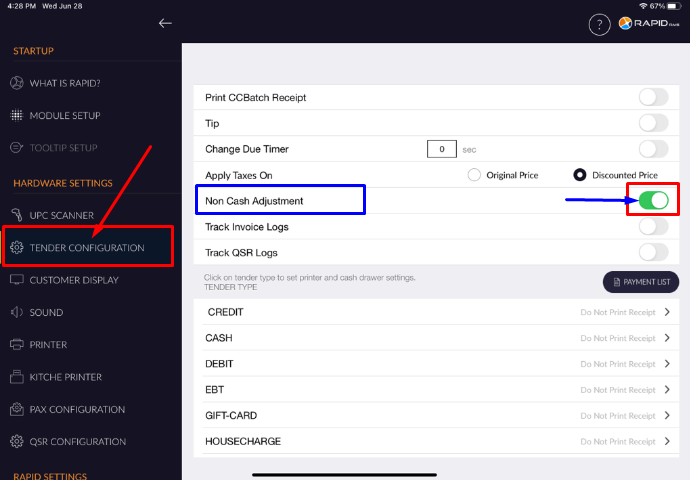

- Click on “SETTINGS”.

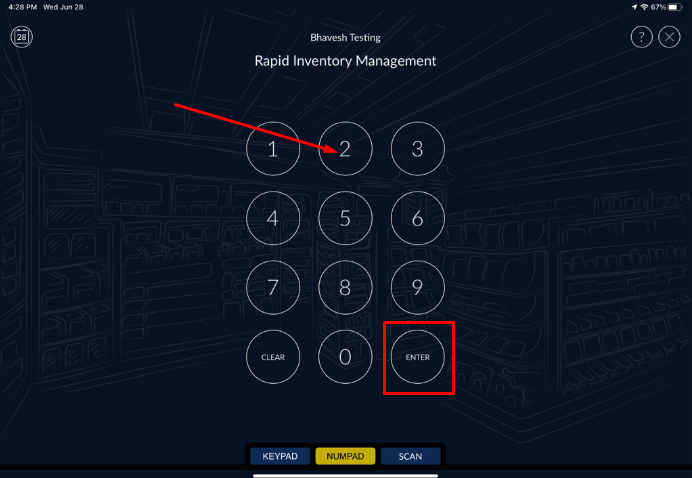

- Ener your quick password and Click on “ENTER” button.

- Click on “TENDER CONFIGURATION” & Please ON toggle button for “Non Cash

Adjustment”.

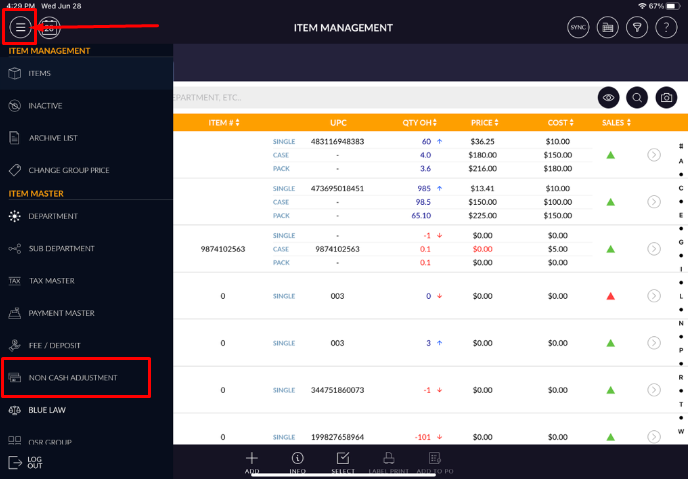

- Now we will configure Non-Cash Adjustment charges/discount from INVENTORY MANAGEMENT.

Ener your quick password and Click on “ENTER” button.

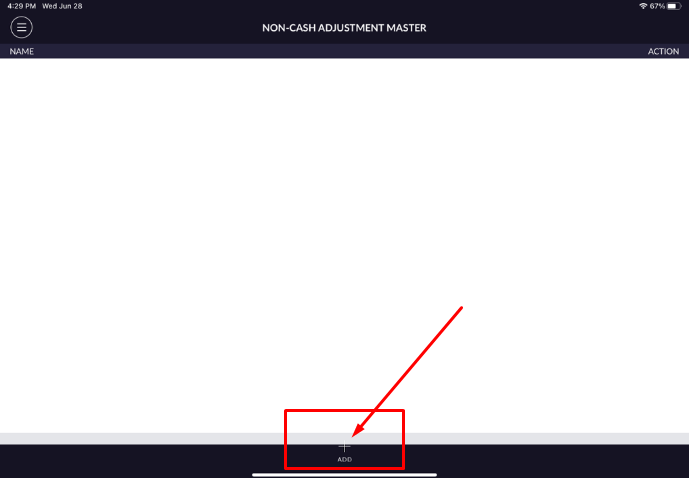

- Tap menu

(located on the top left side corner) & Click on “NON CASH ADJUSTMENT” option.

(located on the top left side corner) & Click on “NON CASH ADJUSTMENT” option.

- Click on “+ ADD” option to creat new non-cash adjustment charges/discount.

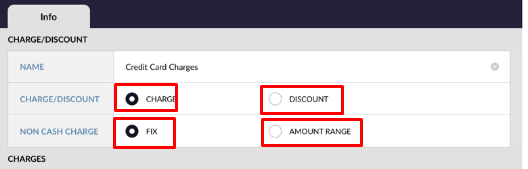

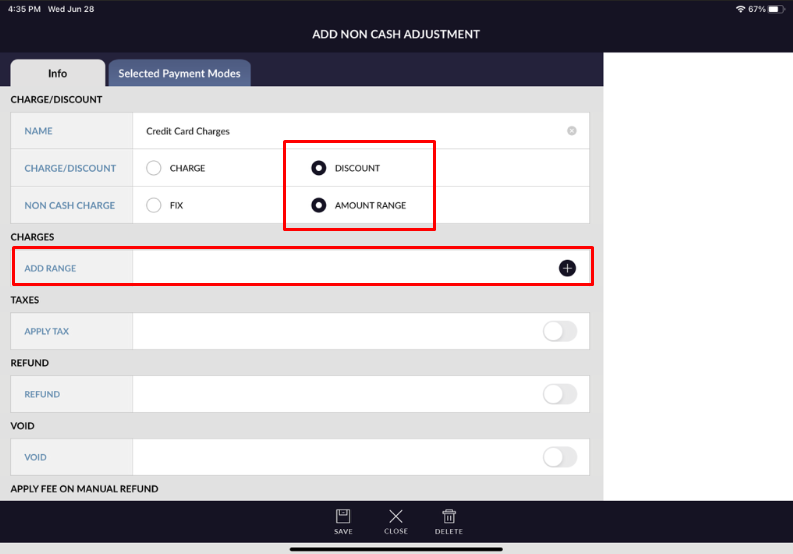

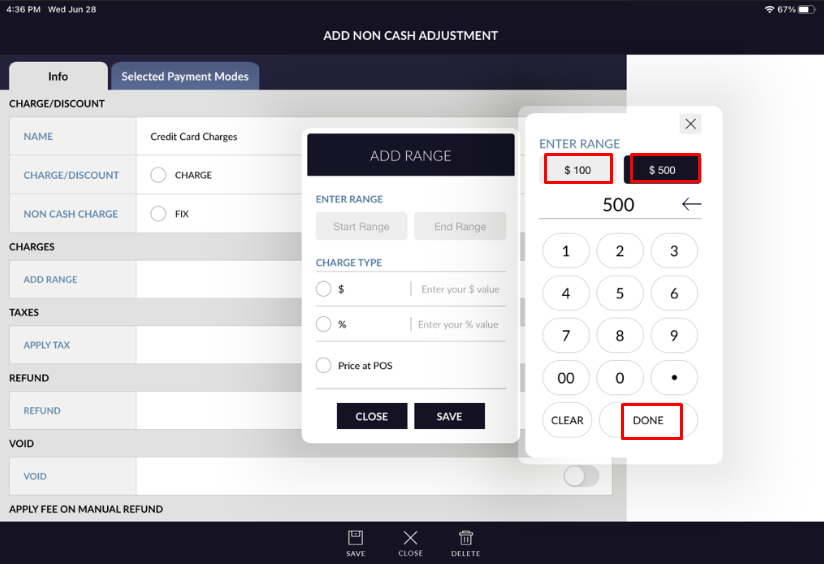

- Here, You can create with multiple combination using “Charge / Discount “ &

“Fix / Amount Range”.

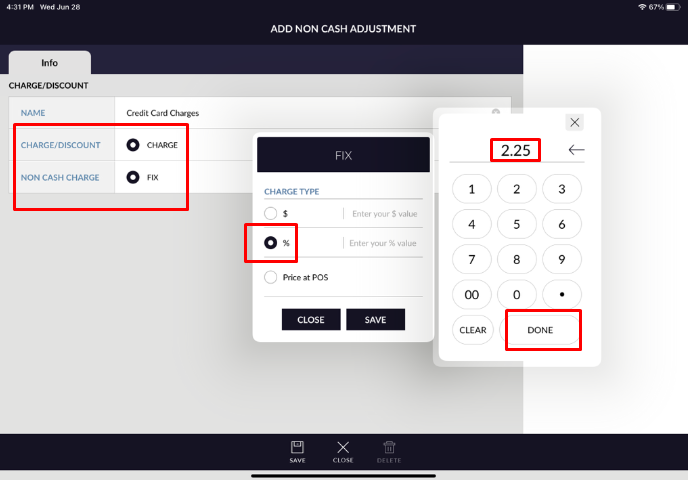

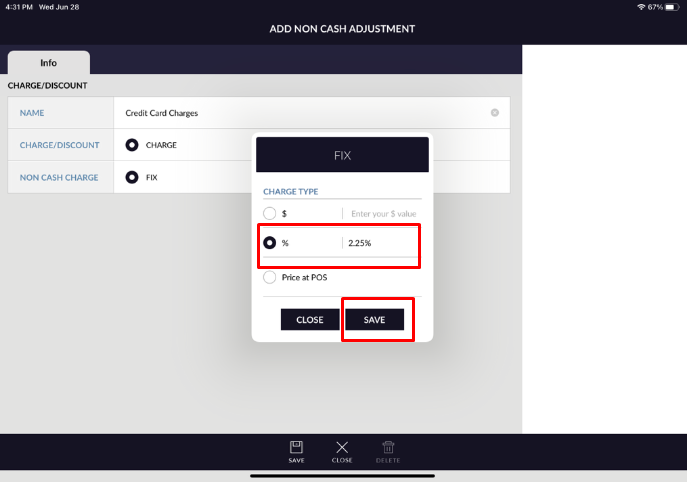

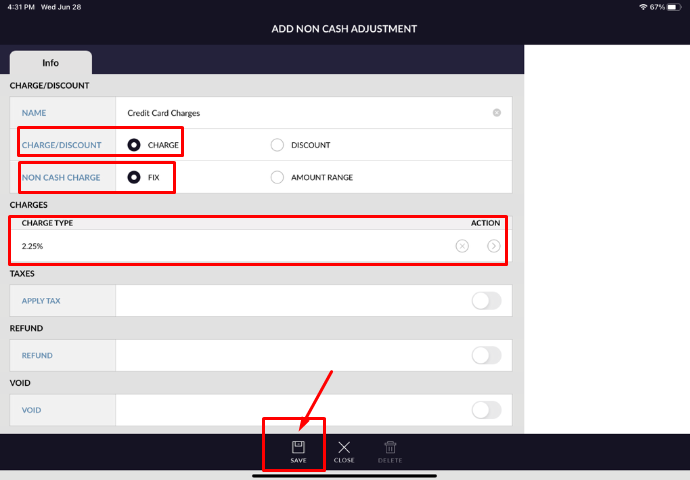

- For Example, Lets creating “Credit Card Charges” with Fix & Percantage % charge type (2.25%). Enter NAME : Credit Card Charges.

- Please select “Fix” Charge option and Enter your 2.25 in Percantage (%) option, then click on

“SAVE” button.

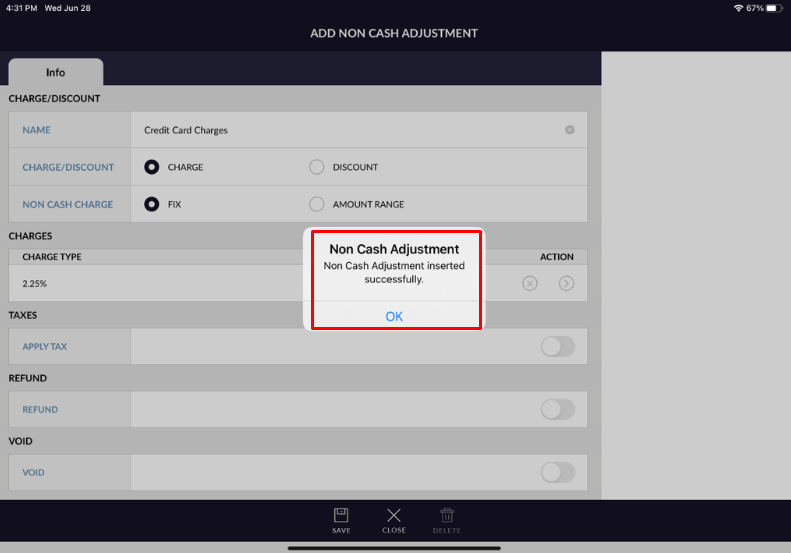

- Once you click on “SAVE” button then you will get popup message with “Non

Cash Adjustment inserted successfully”.

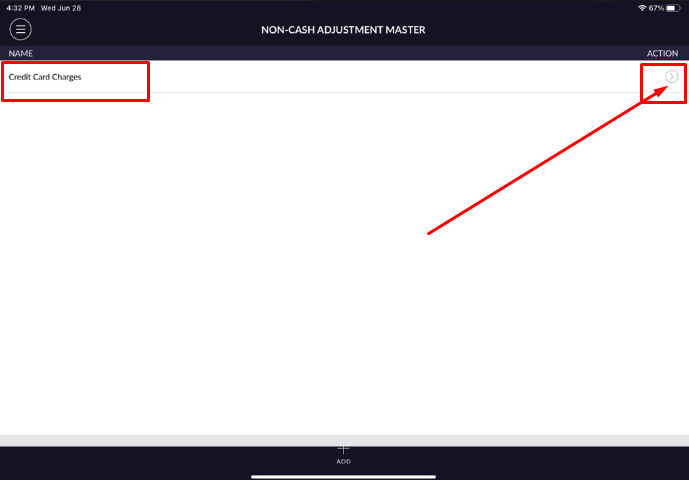

- Now, you can see your Non-Cash Adjustment Charges (Credit Card Charges) created,

please click on “>” from right side to add for payment mode.

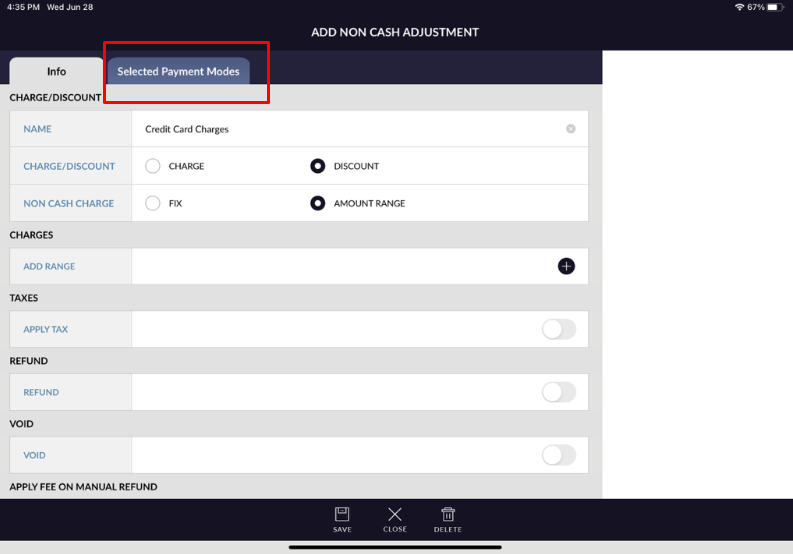

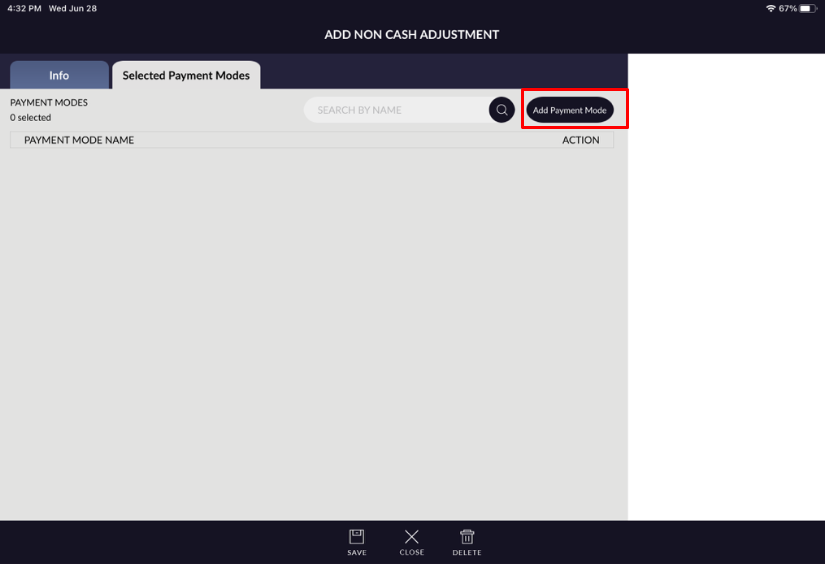

- Go into “Selected Payment Modes” & Click on “Add Payment Mode”.

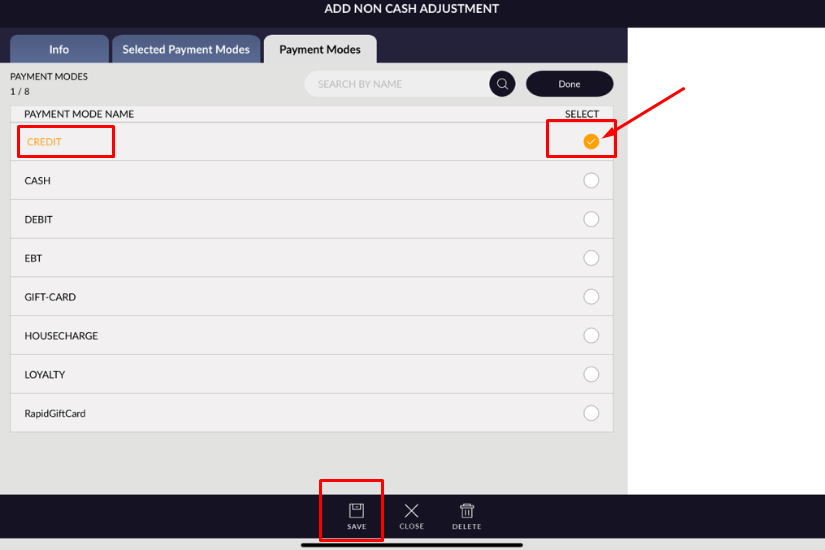

- Now, Please tick against the “CREDIT” Payment to assigned Non-Cash adjustment

charges, then click on “SAVE” button.

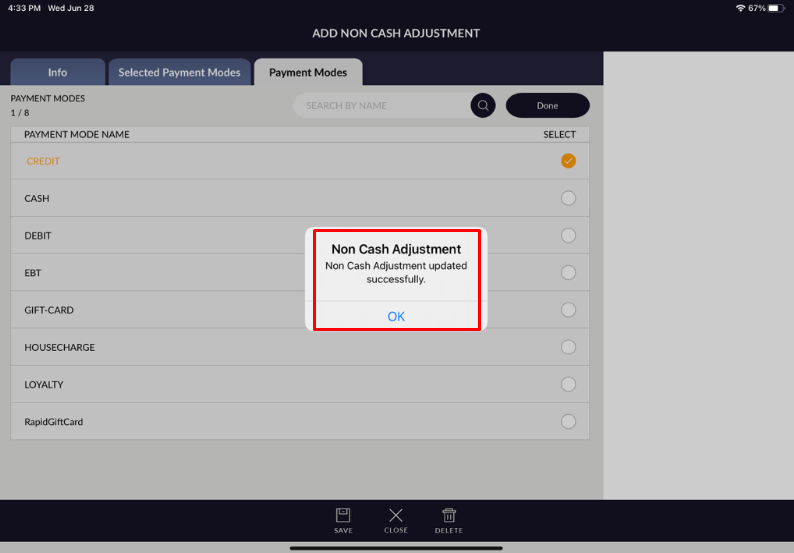

- Once you click on “SAVE” button then you will get popup message with “Non

Cash Adjustment updated successfully”.

- For your information, You can create your Non-Cash Adjustment charges/discount with other combination

also.

For Example, you can create with Dicount & Amount Range combination.

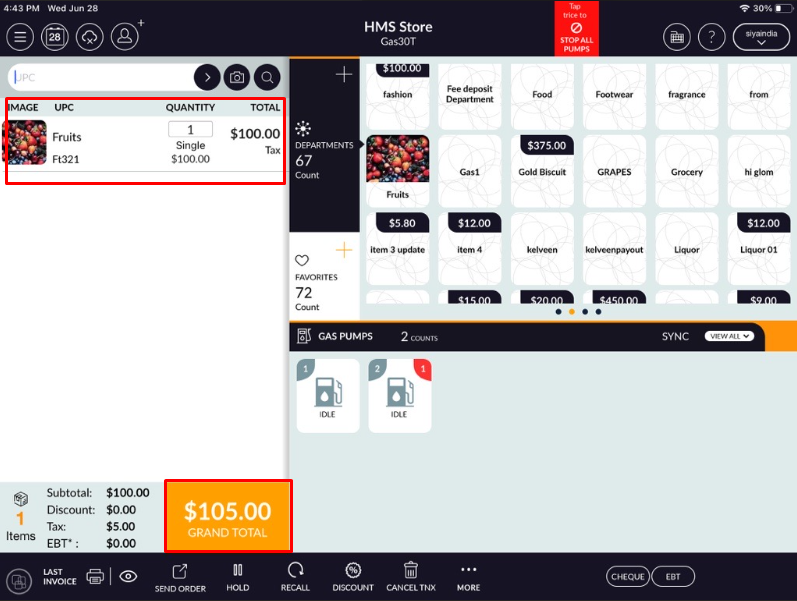

- Now, we can do the sales transcation and see the charges effect in credit payment on tender screen.

For Example, In Cash Register (RCR) lets ringup one item with $100 amount (Total $105 + $100 + $5 tax).

- You can see here, Total invoice amount is $105 including tax and $2.36 is non-cash adjustment

charges against the credit tender.